Introduction

As Britain’s scheduled departure from the EU draws ever closer, the prospect of a no-deal exit becomes increasingly realistic. This would force the UK government to make significant spending cuts while in the process undermining Prime Minister Theresa May’s promise to UK residents that public services such as NHS would now suffer rather than benefit from Brexit after October, 2019.

While the UK and EU financial markets remain cautious, investors have begun to review their portfolios in order to ensure that it remains profitable in the long-run. Investors are aware that how Brexit has continued to wreak havoc on the UK’s economic fundamentals such as its currency. The value of pound sterling continues to slide down as the pound is currently traded within a restricted and narrow range as negotiations continue[1].

Source: The Economist

When compared to other of its EU counterparts, the UK’s economy has been fairly resilient. This was evident even during the peak of the Euro sovereign debt crisis when the UK was recording positive economic growth over the period of 2012-19 but failed to sustain this growth trajectory in the long-run[2] (refer figure 1). In response to the current weak growth rates, UK policymakers were then left blaming the events surrounding Brexit for the depreciation of the pound.

UK’s Economy to Remain Sluggish

Brexit is officially is 3 months away but the significance it is having continues to influence global financial markets. The general consensus is that the no-deal Brexit scenario will negatively impact the UK’s future growth rates (refer Figure 2 above). At the moment, financial Industry experts remain cautious while policymakers are in a disaster prevention mode to ease the concerns of ordinary UK residents.

The arguments favoring the UK to remain as a part of the EU can’t be ignored. For example, there is research that states that in the past, investment in the British financial markets had risen by 53 % to 660 million pounds (USD $974 million), the peak of any EU member[3].

This is clear evidence that both the UK and EU financial institutions’ have mutually profited from Britain’s membership in the EU – via the “passporting” system. Basically, this system enables financial entities licensed in one EU member country to trade across borders with relative ease and with hardly regulatory hassles. Thus, by removing itself from the EU, Britain may stand to lose nearly USD $5 billion in investment over the next 5-years[4]!

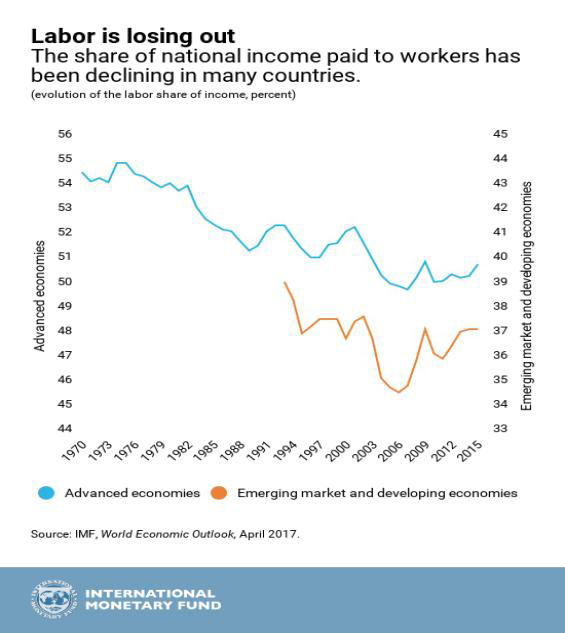

The first possible scenario from the Brexit process will be an exodus of foreign banks operating in the UK. The choice to relocate from the UK will be on the grounds that it makes more economic sense to set-up an office in other EU member states as it more financially feasible. While another outcome of major concern would the disruption to businesses – especially within the financial industry and related sectors that can prove to be damaging to the UK economy that is already experiencing lower labour productivity growth (refer Figure 3).

Fear of Contagion Spreading to the US

Source: Bloomberg

The expected impact from Brexit to both the UK and EU economies is predicted to be damaging and long-lasting especially within certain sectors within the economy. Though, the extent of damage from Brexit to the UK economy is yet to be ascertained but experts forecast the impact to be equally devastating to both the US stocks and the value of the dollar[5] (refer Figure 4 above). The fear that the “contagion effect” from UK’s financial sector spreading across the Atlantic seems to be the biggest concern among investors at the moment.

The reason to fear contagion is highly likely as historically, both the UK and the US economies are closely intertwined via commerce, finance and trade[7]. The bad memories from the Euro debt saga has resulted in global financial market remaining vigilant, specifically on the outcome of the upcoming Brexit vote. There reports that suggest that most US major banks and investors’ alike will remain apprehensive over the next 2-years with the fear of the hidden risks faced by Britain when it leaves the EU[7].

Factors that Guarantee Industrial equipment Investments As Brexit Proof

In this section, we’ll look at how you can make your investment portfolio Brexit-proof by investing in hard assets such as industrial equipment that will prove to be potentially profitable while buffers your portfolio from increased market volatility following the UK’s exit from the EU.

Capital Preservation

The biggest fear among investors of impending consequences of Brexit remains that their capital invested does not evaporate with a “touch of a button”. When it comes to an asset class such as industrial equipment, investors can take comfort in knowing that there is insurance coverage on damaged or missing industrial equipment[8]. This, in turn, translates to asset safety via capital preservation.

As a part of the hard asset family, industrial equipment possess features that can be considered as “risk-free”. There are no financial assets that can be considered risk-free. Thus, if capital preservation remains your primary goal, investing in industrial equipment can be an attractive alternative that provide a nice upside to your existing portfolio.

An immediate challenge for investors to seek ways to preserve their capital. Investors have to first understand and identify which industry will be the hardest hit. The “rule of thumb” to guide investors is to first acknowledge that not all industries are created equal. This means that while some industries will be hit extremely hard by Brexit, others may cope relatively well. It’s important that investors recognize this, particularly for those seeking a safe-haven such as hard assets to preserve your capital.

Source: Thomson Reuters

Through conducting an industry research, investors will be at an advantage as they will be able to recognize which firms and industries are likely to see their share values increase post-Brexit, while identifying those that are expected to become less valuable over time[9]. The obvious benefit will be that it ensures that you not only restructure a balanced portfolio in line with the wider economic climate but optimize your chances of capital preservation (refer Figure 5 above).

Another concern is the possibility that inflationary pressure will “eat-away” the value of your investments. The problem of inflation would likely stem from the widening US trade deficit with China. The common impact of inflation is that potentially erodes the initial capital invested. Hence, the fear of inflation have prompted investors to adopt another approach – the hard asset investment strategy[10]. This strategy is prudent and safe rather than choosing risky investment such as stocks and derivatives are currently viewed as highly risky assets.

Thus, investing in hard assets such as industrial equipment is to create a protective shield to protect against inflationary pressure while ensuring capital preservation[11]. Nevertheless it’s crucial understand the underlying strength of industrial equipment investment which is tangible assets that is negatively correlated with inflation[12].

Diversification Benefits

Diversifying your portfolio will enable investors to mitigate market risk while increasing their potential returns. An asset class to choose when diversifying one’s portfolio is hard assets such as industrial equipment[1]. For instance, if a portfolio that is over-exposed to either stocks or derivatives, will result in the asset worth far less due to inflation or merely driven by speculative behavior which is non-reflective of market value[14].

Source: DEC Database

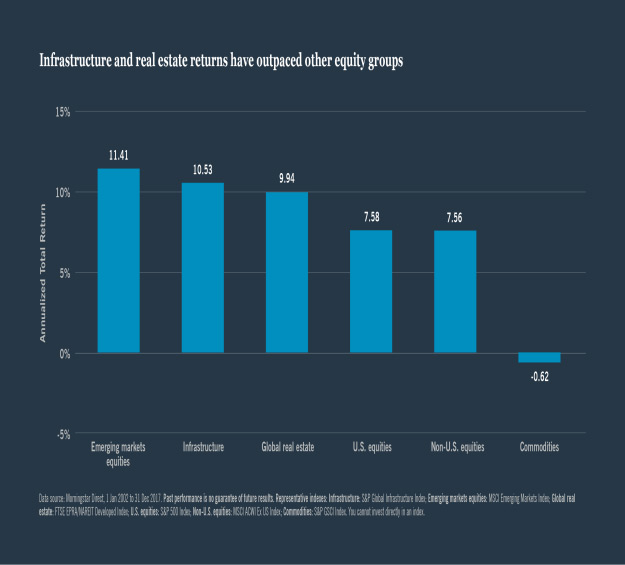

For an investor that intends to reduce portfolio risk arising from Britain’s decision to leave the EU, it has become a necessity to include hard assets such as industrial equipment, into your portfolio. The aim to include hard assets is first to potentially guarantee future returns while the second being the opportunity to spread-out risks between the different asset classes[15]. Furthermore, allocation of capital into hard assets such as Industrial equipment have proven profitable as it constantly outperforms other assets in terms of returns[16] (refer Figure 6 above).

Higher Returns Compared to Banks

Source: The Economist

Investing in hard assets such as Industrial equipment investment during impending Brexit, will prove to be reliable vehicle to invest in[17]. While earning higher returns compared to the low interest offered by banks (refer Figure 7 above). Hence, one of the biggest advantage of industrial equipment investment is the fact you not only preserve “hard earned dollars” but you have successfully avoided exposing your capital to low returns the banks offer. Bottom-line is that you stay clear of various unwarranted market risks that is most likely to arise from the uncertainty currently surrounding the British financial markets due the fear of Brexit.

Industrial Equipment Help Hedge Against the Pound

As an investor, you’ll know that currencies represent a particularly volatile asset class. You may also be aware that Brexit has continued to wreak havoc on the value of the pound, while it continues to trade within a restricted and narrow range as negotiations continue[18].

Source: Bloomberg

The pound recently declined following reports that talks between the UK and the EU had stalled (refer Figure 8 above). Meanwhile a no-deal Brexit scenario would see its value plunge even further in the near-term (in the same way that the GBP sunk to a 30-year low [19].As an investor, it would be wise to refrain from backing the pound post-Brexit, as you instead look to hedge against this currency while favoring the USD and the EUR.

Conclusion

To conclude, as the impact Brexit looms dangerously over both the UK and EU economies, it has become imperative that modern investing strategies need to be adopted to ensure your portfolio remains Brexit proof. One effective strategy that investors should use is the choice of investing in hard assets such as Industrial equipment.

As discussed in this paper, investing in Industrial equipment will will provide an avenue for investors to hold on to a tangible asset with intrinsic value that they can relate to rather than losing their capital from the probable “tsunami” emerging from Brexit and then finally cascading down to global financial markets. For investors, the hidden opportunity lies solely on their decision to invest in hard assets, because once the global economies begin to recover, it will boost the demand for hard asset like Industrial equipment and lead to further appreciation of the asset value.